california mileage tax rate

It is also a way for the state to collect taxes from motorists who are buying and driving electric vehicles. 14 cents per mile driven.

Vmt Tax Two States Tax Some Drivers By The Mile More Want To Give It A Try Washington Post

Proponents argue that the state gasoline tax of 529 cents per gallon.

. DeMaio points to the recently-adopted Regional Transportation Plan in San Diego county as proof. Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based on the number of miles they drive instead of a. As of January 2021 the Internal Revenue Service slightly decreased the required reimbursement rate per mile from 0575 cents per mile to 056 cents per mile.

What Is the IRS Mileage Rate for 2022. California Mileage Reimbursement Frequently Asked Questions. For them the rate is 022 per mile which is.

Down half a cent from 2019 the gas mileage california reimbursement. The following table summarizes the optional standard. The Standard Auto Mileage Rate For Reimbursement Of Deductible Costs Of Operating An Auto For Business Will Be 585 Cents Per Mile.

For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. The plan includes massive sales tax hikes along with a Mileage Tax of. California Considers Placing A Mileage Tax On Drivers.

Unless otherwise stated in the applicable MOU the personal aircraft mileage reimbursement rate is 126 per statute mile. Mileage Rate for Medical and Medical-Legal Travel Expenses Increases Effective July 1 2022. 0625 per mile from July 1 to December 31 2022.

18 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed Forces up 2 cents from the rate for 2021 and. The new rate for. Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be.

The IRS rate for 2022 was set at 0585 per mile in December 2021. The California income tax has ten tax brackets with a maximum marginal income tax of 1330 as of 2022. The mileage reimbursement rate is different for medical or moving purposes for active-duty members of the US.

The official IRS business mileage rate for 2022 is. California workers comp medical. California mileage rate in 2022.

Detailed California state income tax rates and brackets are available on this page. 2022 Personal Vehicle Mileage Reimbursement Rates. The Division of Workers Compensation DWC is announcing the increase of the.

The standard mileage rate for 2021 taxes is 56 cents per mile driven for business 585 cents per mile for 2022. California also pumps out the highest state gas tax rate of 6698 cents per gallon followed by Illinois 5956 cpg Pennsylvania 587 cpg and New Jersey 507 cpg according. 15 rows Standard Mileage Rates.

0585 per mile from January 1 to June. 56 cents per mile driven for business use down 15. 585 cents per mile driven for business use up 25 cents from 2021 rates 18 cents per mile driven for medical or moving purposes for qualified active-duty members of the Armed.

Effective January 1 2021 the personal vehicle mileage reimbursement ratefor all state employees is 56 cents per mile.

Thoughts At A Workshop On Replacing Ca S Gas Tax With A Mileage Fee Streetsblog Los Angeles

Mileage Reimbursement Rules Rates And Tracking Mileagewise

/Calculating_Mileage_for_Taxes_GettyImages-88327427-f6e3ca37a370470f9c3958ab60cf19dd.jpg)

Irs Announces Standard Mileage Rates For 2022

2021 Standard Irs Mileage Rates For Automobile Operation

Mileage Reimbursement A Complete Guide Travelperk

Everything You Need To Know About Vehicle Mileage Tax Metromile

The Current Irs Mileage Rate See The Irs Mileage Rates For This Year

.svg)

California Mileage Reimbursement Learn About The Mileage Rules In Ca

California Employers Association 2022 Irs Mileage Rate Is Up From 2021

Thoughts At A Workshop On Replacing Ca S Gas Tax With A Mileage Fee Streetsblog Los Angeles

Biden Infrastructure Bill Is There A Mileage Fee Wusa9 Com

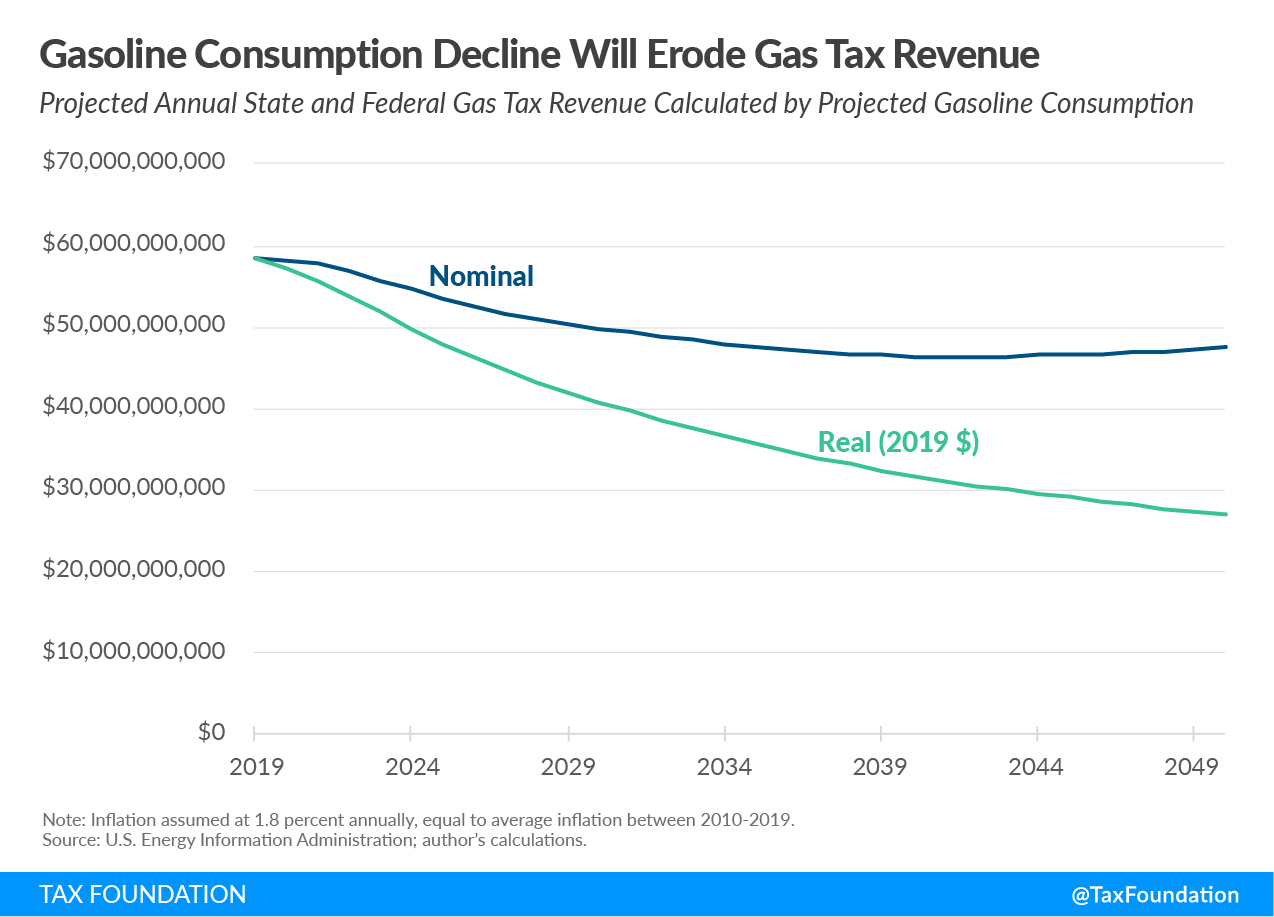

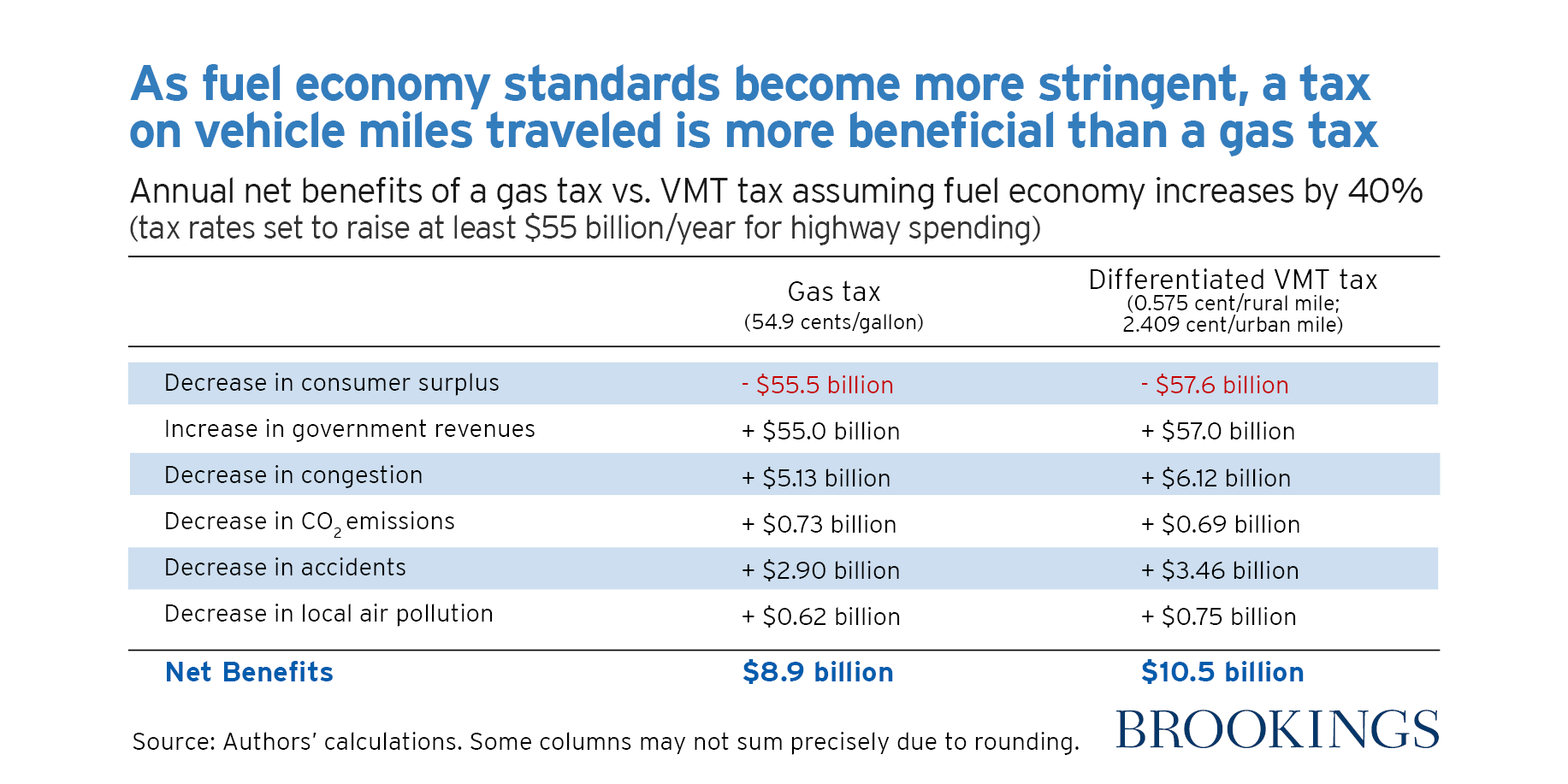

What Is The Highway Trust Fund And How Is It Financed Tax Policy Center

Mileage Log Template Free Excel Pdf Versions Irs Compliant

Why It S A Bad Idea To Tax People For Every Mile They Drive Grist

Vehicle Miles Traveled Vmt Tax Highway Funding Tax Foundation

Mileage Reimbursement Rate Increases On July 1 Hrwatchdog

Ditching The Gas Tax Switching To A Vehicle Miles Traveled Tax To Save The Highway Trust Fund